Commercial paper

The market for short term commercial paper is freezing up. The difference between the three-month commercial paper interest rate and the benchmark government overnight indexed swap rate increased to over 1 percentage point, from 0.24 points at the start of the month. Total amount of commercial paper outstanding is $1.1 trillion.

March 17: Fed launches $10 billion fund to help liquidity in commercial paper.

Bank Lending

Bank lending is also freezing up. Overnight interest spread for between bank lending is increasing.

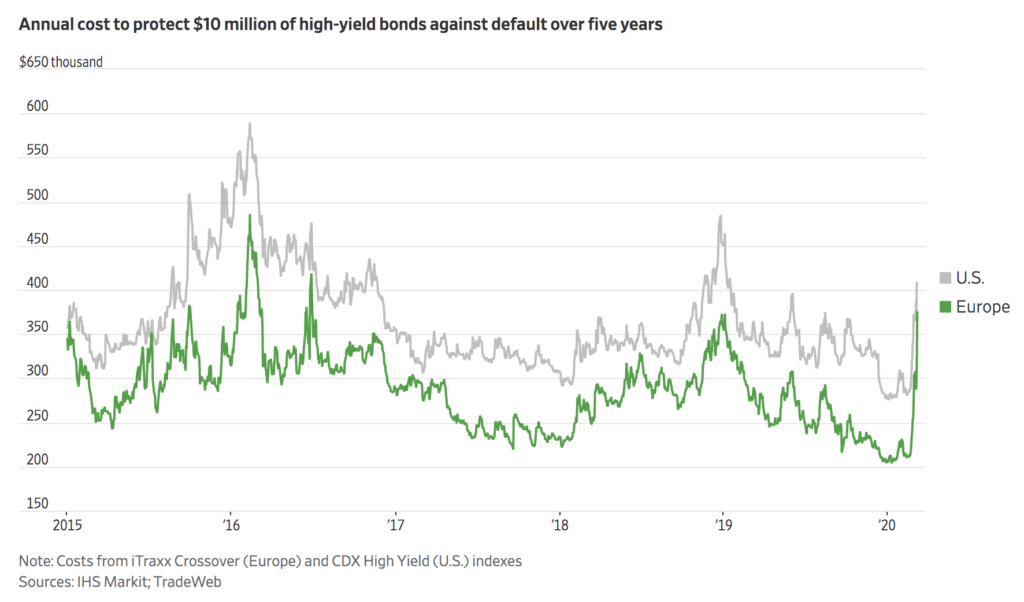

High yield debt

The performance of corporate bond markets has held up surprisingly well. The S&P high yield bond index is down about 13% as of March 16. The cost of insuring bonds against default, however, has been rapidly increasing

Municipal bonds

Muni bond market is doing okay, only off 1.2% as of March 16.

One thought on “Coronavirus storyline #5: debt markets”